Axi Review 2023 Verified Customer Reviews

19. Oktober 2020, von Sebastian

19. Oktober 2020, von Sebastian

They are licensed and do all legitimate checks and ensure the client is ready and qualified to trade. Call centers do not harass customers at silly times with spoofed mobile numbers. The platform is friendly and efficient by auto generating and emailing log in details. Richard Gibson and Milan have been very patient with me and my team and have assisted in ever technical or financial issue we have had. I would recommend AXI trading and affiliation services to anyone.

Axi is a global online FX and CFD trading company, trusted by 60,000+ ambitious customers in 100+ countries around the world. Axi has made giant strides since its inception in 2007 to become a top 10 global broker, developing a reputation for its innovative, customer-focused approach, and advanced AI technology. Minimum deposit – Opening a trading account with Axi is very easy, all can be done via the web. Of course, with a zero balance, Axi’s customers will not be able to open any trades. But will enable Axi client’s to have a real feel for the broker’s trading platforms, how the spreads widen on high impact news and for the overall trading conditions.

Finally, fees and commissions should affect your decision of which online broker is best for you. Fees and commissions shouldn’t be excessive, and you shouldn’t feel like you’re losing an exorbitant amount of money. Online brokers have been slashing fees and commissions lately, a trend investors hope continues.

Fees

Blueberry Markets also provides short how-to guides about trading on the MetaTrader platform. Finally, there are video tutorials for traders who want to expand their knowledge of trading, whether they are advanced or at a beginner level. Thinking in terms of disadvantages and advantages, you’ll find that online brokers have their pros and cons, just like any other service. The Massachusetts Institute of Technology has called online trading an “internet revolution.” Despite the prevalence of online trading, choosing an online broker isn’t easy.

To get things rolling, let’s go over some lingo related to broker fees. Commission fees can differ depending on the trading type, financial asset type and what level of trading account you have. A broker may dowmarkets charge a commission fee as a service charge for facilitating the buying and selling of financial assets through your trading account.

Usually, in addition to payments by credit card and bank transfer, online services are also offered. These include, above all, Skrill and Neteller, which are represented almost everywhere. However, a higher maximum leverage does not have to mean that the broker is also better. It is true that larger profits can be achieved faster with a higher leverage.

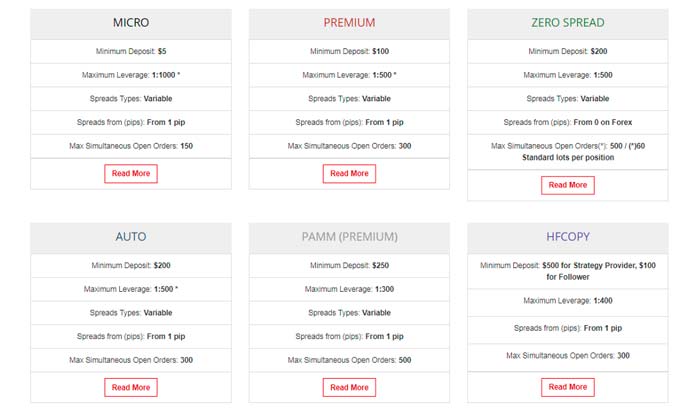

BLUEBERRY MARKETS Account Types

Both trading platforms are available for desktop and mobile trading. The broker offers a limited selection of about 150 assets to trade, including forex, indices, stocks, commodities and cryptocurrencies. With regard to seriousness, further research is being carried out.

Eightcap Review 2023: Is It a Legit Forex Broker? – CryptoNewsZ

Eightcap Review 2023: Is It a Legit Forex Broker?.

Posted: Fri, 07 Oct 2022 14:26:05 GMT [source]

Apply via a form on the Blueberry website, and the brokerage will contact you to talk about setting up a VPS. Blueberry Markets is a market-maker, founded in 2016 by Dan Hyde, a former AxiTrader executive. There are now 30,000 traders at Blueberry Markets, and the broker has been named one of Australia’s most trusted brokers. At the Finder Awards in both 2020 and 2021, Blueberry Markets was named a “Finalist” in the “Best Online Customer Service” category.

Online Brokers

If you want to trade your favorite pair, inform yourself before signing up on the broker’s page how high the leverage is then. In the section „the broker support in the test“ we always briefly introduce the support options of the respective broker and tell you what to think of the general selection of contact options. The support times are also taken into account, i.e. the times at which support staff are available. There is no need to repay any debt or pay for anything else – the only cost for the transaction will be clearly displayed by the broker beforehand. However, there are several additional things Forex traders should be aware of when using leverage.

FXTM Review 2023: Is This Broker Platform Safe for Trading? – CryptoNewsZ

FXTM Review 2023: Is This Broker Platform Safe for Trading?.

Posted: Thu, 20 Oct 2022 07:16:24 GMT [source]

The site Macdougallecology.ca is particularly careful to ensure that all readers have an objective axitrader review of the broker. Therefore, in addition to the background of the company, we also look at the many different regulations and licensing. We check in which country a license is available and since when this has been the case. In addition, we will take a close look at what the Forex broker says about the legal situation and how to react to it. Deposit insurance, for example, is an essential aspect that is prescribed by the European Union and must be complied with by all providers. The point is that the client’s funds must be kept separately from the business capital in their own accounts.

I demand to provide me with confirmation of sending money , they refuse to do this. It decides how many currency pairs can be traded at a broker at all. The point of deposit and withdrawal to a certain extent, of course, belongs to the sub-point of seriousness.

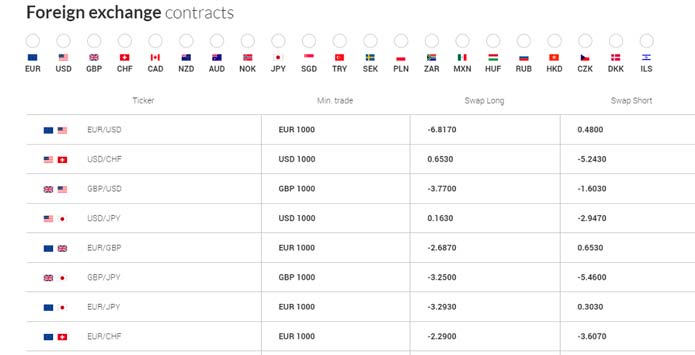

Using this account type, traders get fixed spreads starting with 1.0 pips. The Axi Pro account is more competitive, compared with the Standard, with lower spreads. For the EUR/USD pair the spread starts at 0.0 pip, with a typical spread of 0.4 pip. To get the benefit of the lower spread, Axi charges a commission. The standard lot commission for 1 lot is 7.00 USD (3.50 USD per side, per lot), or the equivalent on your account currency. This commission is also average when compared with all the other top FX brokers.

Axi’s trading spreads are, in general terms, low and in line with the spread and fees structure of other brokers. With a Standard trading account the typical spread for the EUR/USD ranges from a minimum of 1.0 pip to an average of 1.3 pip, without any trading commissions. We consider this spread to be average when compared with other top brokers.

The Standard and Direct https://forex-reviews.org/s, respectively, work well for traders who want traditional spread pricing or raw spreads/fixed commissions. DupliTrade, as you may have guessed from the name, is a copy trading platform that allows you to automate trading using signals from expert traders. DupliTrade selects the best of the best , and you choose from a few different strategies when setting up the platform. The interface is easy to use, and its customer support is available 24/5.

Brokers are your interface through which you, as a private investor, can actively participate in trading currencies and currency pairs. With a deposit with a broker you have direct access to the market and get the chance to bet on rising or falling prices of a currency. The following table contains an overview of all brokers with whom we have already gained experience. With one click you can view our experience report on the respective provider. Another top feature of Blueberry Markets is its analytical offerings.

- Please check all the information on the broker’s official website to prevent possible misunderstandings when using false or outdated information.

- I have evidence to support my claims, including email conversations, WhatsApp chats with my account manager and screen recordings of my trading experience.

- You won’t have downtimes caused by connectivity issues, and you can execute trades in one to three milliseconds.

- Around 4.1% of TD’s outstanding shares were out on loan to hedge funds, while the second-most shorted bank stock, JP Morgan, only had $2.3 billion worth of shorts, showed the data.

- Should your account be inactive, it will be archived when your balance is under 50 units of its base currency and the inactivity has surpassed one month.

Only a broker who has no fraudulent intentions and in which the customer’s well-being is in the foreground strives to make withdrawals dutifully within an acceptable time frame. As it should be for a sufficient test, we would of course also like to make our own experiences with the support. That’s why we think about several test questions during our broker tests, with which we approach the support at different times.