Solved: What is the total amount of traceable fixed manufacturing, Financial Accounting

31. Oktober 2022, von Sebastian

31. Oktober 2022, von Sebastian

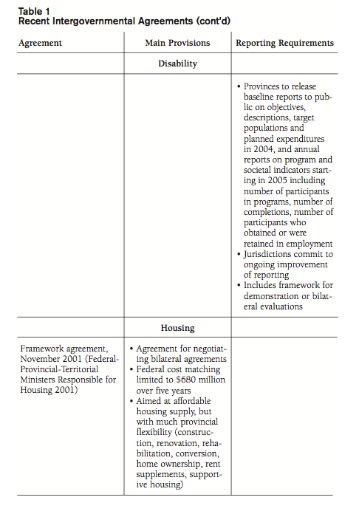

For example, the rent a company pays for a building for the term of the lease is a fixed expense. Common fixed costs are organization sustaining fixed costs that are allocated to the segment. These fixed costs will continue even if the segment has been eliminated; they will just be allocated to the remaining segments.

- Only for the company as a whole is net income computed; this is, of course, the appropriate figure to use for evaluating the company as a whole.

- During the economic downturn in early 2020, which impacted travel, GE’s most profitable business, its airplane engine business was hit hard.

- For example, the depreciation expense of the machinery is the fixed cost for the company.

- Cost tracing is the technique of directly linking a cost to a product that is being manufactured, while cost allocation applies costs to items using estimations.

- They allow managers to make informed decisions about the profitability of a particular responsibility center.

- The first step in reducing your credit card debt is determining which cards have the highest interest rate, as you should prioritize these for consolidation.

The calculator will evaluate and display the average fixed cost of the good. This calculator can also evaluate the fixed costs given the total costs and variable costs. The differences between traceable and common fixed costs come from the point below. In the case where the machinery is used specifically for a project, the depreciation on that particular machinery will be regarded as a traceable fixed cost.

What is the definition of a segmented income statement?

A fixed expense is known as a common expense if it is not tied to a specific segment of the business. If it is tied to a specific segment, then it is a traceable fixed expense. There are two types of fixed costs that should be considered, direct fixed costs and common fixed costs. If we look at Product A, it does have a positive contribution margin. This is important because the product is covering all of it’s variable costs and it is contributing toward foxed costs. While the contribution margin is not high enough to cover all of the fixed costs, increasing sales of Product A would increase contribution margin and lower the loss.

What is the difference between traceable and common fixed costs?

Traceable costs arise because of the existence of a particular segment and would disappear over time if the segment itself disappeared. division manager. Common costs arise because of the overall operation of the company and would not disappear if any particular segment were eliminated.

Fixed cost is the cost that will occur regular basis regardless of the production quantity. The cost will remain the same over a period of months, quarterly and annually. Fixed cost will not change based on the production while the variable cost will change depending on the number of production. For example, certain fixed costs are specific to certain functions or certain lines of operations within a business. It becomes imperative to consider these costs to get a fair idea of the profitability of a certain segment. No single segment can be regarded as the sole reason of this cost.

M4: Discussion – „Traceable and Untraceable Fixed Costs“ Suppose…

Thus for effective decision making both favorable and unfavorable variances should be investigated. Businesses give priority to Unfavorable variances to get the reason for having an unfavorable estimate. But at the same time investigating favorable variances also helps in knowing the factors for having favorable results. Will management place equal weight on each of the variances exceeding $8,000?

Controlling traceable fixed costs is straightforward as they relate to a specific segment or center. Since many factors contribute to the latter category, controlling and eliminating them is more challenging. It would be unfair to include the common fixed costs in evaluating the segments since these costs are not traceable to the existence of any of the segments.

Most popular questions for Business-studies Textbooks

Costs that may be directly allocated to particular cost objects based on the cause-and-effect connection between the cost object and the cost are known as traceable costs. Costs that cannot be traced to individual cost items are referred to as common costs. In reality, variable costs are not entirely avoidable in a short timeframe. This is because the company may still be under contract with workers for direct labor or with a supplier for direct materials. When these agreements expire, the company will be free to drop the costs. Traceable fixed costs are crucial for management decisions.

The following equation can be used to calculate the average fixed cost of a service or good. Marginal analysis is an examination of the additional benefits of an activity when compared with the additional costs of that activity. Companies use marginal analysis as to help them maximize their potential profits. General Electric is another company that reevaluated its product offerings.

Management

Even the first class cabinet is empty the entire landing fee must be paid. So the landing fee is not a traceable cost of the first class segment. But on the other hand paying the landing fee is necessary in order to have any first, business and economy class passengers.

If the cost object is the production department, the direct and indirect department costs are likely to be partly fixed and partly variable. For example, the production department has it own electric meter to measure the electricity used to operate its equipment. Therefore, the electricity cost is a direct production department cost that is variable since it changes with the volume of products manufactured. On the other hand the salaries of the production department supervisors are a direct production department cost that is fixed. In most cases, but not all, avoidable costs apply to variable costs rather than fixed costs.

What is traceable and non traceable cost?

Traceable cost: Which are easily be identified by a producing unit. Non Traceable cost: Which are not traceable to plant, department of unit of operation. Explicit cost & inexplicit cost: Total cost of production of a commodity can be said to include.