Types of Forex Charts And How to Read Them

02. Dezember 2020, von Sebastian

02. Dezember 2020, von Sebastian

Content

However, if traders want to know more about what happened during the trading day and see the price fluctuations in clear detail, line charts just don’t cut it. If you just want a broad overview, line charts work, but for more information, you need to look at another type of chart. While you can compare historical prices by looking at forex quotes, it’s much easier to view a chart that you can set up to display the time frame of your choice. What kind of chart you need depends on your trading style—some traders like to bet on daily price fluctuations, while others play the long game. For example, some of the most common currency pairs are EUR/USD and JPY/USD—beginners learning to trade forex usually trade these major pairs due to their stability and predictability.

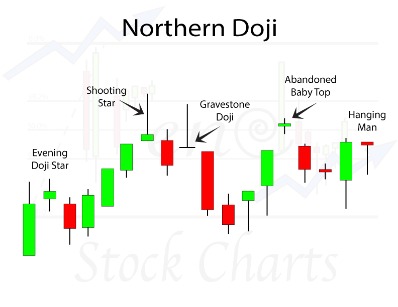

In addition, they may employ different strategies to capitalize on multiple movements, including trend-following and countertrend strategies. Forex chart analysis is the process of analyzing the price action of currency pairs over time to identify trends and patterns. Traders can conduct analysis using various technical indicators and chart patterns. By mastering forex chart analysis, forex traders can increase their chances of success. Bar charts are another type of forex chart that shows the open, high, low, and close prices for a specific period.

How to interpret Bid and Ask in Forex

As you get more familiar with these charts, you will be able to identify patterns in the charts, like whether a price is trending up or down or if it is stagnant. Eventually, this will help you find opportunities and shape your forex trading strategy in the best way possible. In general, reading a forex chart is about understanding the relationship between two currencies. No matter if you are referencing a bar chart, candlestick chart, or a line chart, these elements remain constant. All charts are simply visualizations of price action over a specified period. If you are planning to rely on general market commentary and financial news, then a line chart might do the work for you.

- These candlesticks filter out some noise in an effort to better capture the trend.

- A line chart is the simplest type of chart that draws a line from one closing price to the next closing price.

- Traders from around the world rely on candlestick charts to further their forex chart analysis.

- By understanding how to read forex charts, traders can identify important levels of support and resistance and make profitable trades.

They are also useful in identifying trend reversals in determining which direction the market is going to go. They are similar to bar charts but provide more information about price movements. Candlestick charts show the opening, high, low, and closing prices for each time period, but they also provide information about the strength of the price movement. The price action of currency pairs is illustrated by bar charts in greater detail.

Forex, Indices, Gold, Crypto and Share CFDs

You can add charts to your “Favorites” section so that the prices of currencies and other financial instruments you need were always at hand. That’s it – you can just click on the star symbol of the currency you need to form your own list of online charts. Finding the right combination is different for every trader, so it’s important to start with the basics before you start working your way into using technical indicators (which we cover later). The horizontal hash on the left side of the bar is the opening price, and the horizontal hash on the right side is the closing price.

- Line charts, bar charts, and candlestick charts are the three primary varieties of forex charts.

- Thus, what you may well be seeing here is a currency that is losing its strength, and the uptrend may have disappeared.

- A forex chart, thus, graphically depicts the historical behavior of a currency across various time frames, along with technical patterns & indicators and overlays.

- There are various types of forex charts, including line charts, bar charts, and candlestick charts, each with its unique features and benefits.

The close prices are joined together so that the consecutive points form a line. Learning how to read forex charts is one of the first steps you’ll need to take if you’re looking to get into trading. Here we explain how you can read the four main types of FX charts to help you get started. Remember to practice regularly, using demo accounts or backtesting strategies, to gain experience and increase your confidence in analyzing forex chart patterns. Forex charts can be viewed in various timeframes, such as hourly, daily, weekly, or monthly intervals.

Heikin-Ashi Candles

On IG’s trading platforms, you can choose how frequently new data is plotted to a chart by selecting a timeframe, ranging from tick-by-tick to a whole month. Each category contains several specific patterns that help traders anticipate and capitalize on market movements. Due to the unpredictable nature of the world economy amidst COVID-19, forex trading opportunities are more plentiful than ever. A recent example is what happened to EUR/USD no long ago when talks of a new stimulus package kicked off in the US.

For our ‘filled’ blocks, the top of the block is the opening price, and the bottom of the block is the closing price. Candlestick bars still indicate the high-to-low range with a vertical line. When you see the word ‘bar’ going forward, be sure to understand what time frame it is referencing. The fluctuation in bar size is because of the way each bar is constructed.

What is a Forex chart?

Unlike Japanese candlesticks, each new candle opens at the middle of the previous candlestick’s body. But these candlesticks filter out some noise in an effort to better capture the trend. These candlesticks filter out some noise in an effort to better capture the trend. The main purpose of the chart is the ability to always refer to historical data and see how the price was changing some time ago. Then, based on these data, you can see some regularities or chart patterns (cyclical nature), and suggest a forecast for the future and assume what the price chart will look like after a while. It is the necessity to refer to the history and a search for pattern formed the need to present the chart in a new way, different from a common horizontal or vertical line.

It is necessary to have a look at charts and understand everything I will write further. Click on the Registration button on any page of the website, it is in the top right corner and follow the instructions. Next, you click on the Currency section and select the chart of the most popular Forex currency pair, the US dollar versus the euro (namely, the exchange rate for the EURUSD). The appearance of different Forex charts may discourage many traders, especially newbies. It seems that only an experienced trader can understand and correctly read trading charts. This type of chart is usually used to get a “big picture” view of price movements.

The primary purpose of a Candlestick chart is to indicate the high to low range for a particular currency pair during a given time period. They are similar to bar charts, except they are more detailed, and much better looking. Each Forex chart has its own indicators and parameters, and it needs to be read differently from the rest. We are going to tell you about the main types of currency pairs trading charts, and how should you read them. It is worth noting that exchange rate and previous performance indicators are the main constituents of any Forex chart.

The course starts with teaching you the basics of reading forex charts and proceeds to teach you the more advanced methods, and practices used by Forex traders. Ask any experienced Forex trader about a few must-have tools for Forex trading, they would certainly mention Forex charts and for the right reasons. A Forex chart is essential for Forex trading because it allows traders to have a look at the historical behavior of a currency pair across different time periods. A support level is a level where the downward price trend of a currency pair pauses as buying demand increases, so the trend reverses and turns upward. The same reasoning applies to resistance levels where the upward price momentum of a currency pair weakens and the price is likely to reverse and head downward.

Enrol for our 3-day accelerator program to unlock access to the trading room. Our partners cannot pay us to guarantee favorable reviews of their products or services. AxiTrader Limited is a member of The Financial Commission, https://g-markets.net/helpful-articles/ig-index-client-sentiment-analysis-using-excel/ an international organization engaged in the resolution of disputes within the financial services industry in the Forex market. This website is using a security service to protect itself from online attacks.

It’s no different here, but we are using it to our advantage this time. The EUR/USD chart will show exactly how many dollars you could buy with one Euro. The first currency is called the “base” currency and the second is called the “quote” currency, and the wiggly line on the chart tells you how much 1 EUR costs in USD over a selected period. Charts are the one and only thing that can tell you where currency prices are going. With that being said, you need to know what are the advantages and disadvantages of using line charts.

Support and resistance indicator: What is, How to use, and Best Strategies

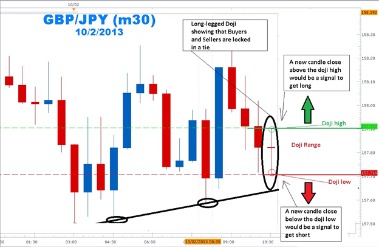

Active traders commonly use these indicators, since they are designed to analyze short-term price movements. In the Heikin-Ashi chart type, candlestick chart patterns like, doji, for example, are much more important. This is a very simple way to display pricing data as it does not give any indication of what the high, low or open price for the period was. For this reason, many forex traders only use line charts when assessing long-term trends, where some of the additional information may not be quite as relevant as it is when trading short-term patterns.